Don’t be shocked dear readers, but when I’m not out shopping, I do try to balance my checkbook and count my pennies. These are mundane tasks, but as necessary for living well as searching out thrift stores for my beloved Chanel. If I could outsource the task, believe me I would. But sadly, I can’t afford it. And, let’s face it, no one cares about my money as much as me! Last time I went to a financial advisor, they tried to sell me a bunch of “load” mutual funds that would’ve netted them a nice commission with questionable ROI for me. Instead of taking the sales advice, I bought a book on financial planning, opened a low cost brokerage account and made some thrifty investments in no-load funds. These days, instead of buying books, I’m more inclined to surf the Internet to find savings tips. One good free resource I have discovered are tips from Women & Co. You might want to check out their new worksheet, Set and Achieve Your Financial Goals. Believe me, I am studying it for tips! As Voltaire said, “Common Sense Isn’t.” Neither is Common Cents right now.

Recently, I asked Women & Co. to share with our readers some simple tips for financial fitness. Following are their recommendations. If only Gov. Schwarzenegger and the California legislature had used these tips, perhaps the state of Cali-fornia would not be on the brink of disaster.

Assess Your Health: Gather all important financial statements and review what you own, your assets, and what you owe, your liabilities. Look carefully at how you’re putting your hard-earned cash to work – what you’re earning, spending and saving. Then set aside some time every few months to file important papers and keep them organized.

Know Your Numbers: Your credit score is a key indicator of your financial health. It’s a primary criteria used by lenders to determine your likelihood of defaulting on a loan and that may impact your ability to get many types of loans, including a mortgage. Request your free annual credit report from each of the 3 major credit bureaus at http://www.annualcreditreport.com/.

Set Your Goals: Once you know where you stand today, set goals. Short-term goals are those you’d like to accomplish within one year (e.g., pay off credit cards); mid-term goals, within 5 years (e.g., make down payment on a new home); and long-term goals, 5 years or more (e.g., save for retirement). Write these down, using the worksheet from Women & Co. to help you clarify and prioritize your financial goals.

Protect Yourself: Maintain appropriate insurance coverage; keep your beneficiary forms for your 401(k), IRA and insurance up-to-date; and put your wishes in writing by executing a will, living will, power of attorney and health care proxy.

Conduct Annual Check-ups: Review your finances at least once a year with your financial advisor. Keep in mind that life transitions such as having a child, getting married or divorced, or moving to another state, often bring with them financial, tax and legal implications.

Remember financial well-being requires on-going maintenance to stay in shape. This summer, I am taking a resolution to dust off my old Jane Fonda fitness tapes and work on balancing my budget (again  ).

).

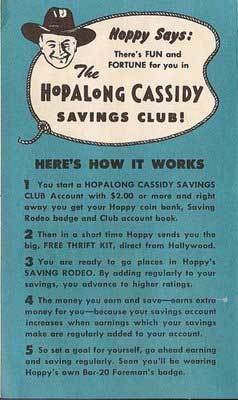

Pictured: A Poster for the old Hopalong Cassidy Savings Club

Do you have any tips you’d like to share? If so, please leave a comment and let all blog readers know. Regrettably, the days of the Hopalong Cassidy savings club have passed and we all have to come up with our own savings club!

4 Comments